Robo Advisors are known as automated investment, they are algorithm driven by A.I. to find the best return possible. Unlike traditional funds that require a team lead by a manager, Robo-Advisor does not need these, thus they tend to charge a low service fee.

Continue ➤ 28 Investment Advises By Warren Buffett On Wealth Management

The main advantage of using a robo advisors service is the super low cost fees, a traditional fund may charge you a yearly fee of 1 to 2% based on the NAV of the fund. Assuming that a fund charges 2% per year, and if you compound the 2% yearly, it will be more than 20% in 10 years, possibly 30%. This is a huge amount you are paying to the fund company just to manage the fund you invested in.

Pros and Cons of Robo Advisors

- Robo Advisors are cheaper than mutual funds, fees are cheaper as you invest more.

- Robo Advisors are not emotional driven like a manager for a fund, they are algorithms based artificial intelligence.

- Robo Advisors are not risk free, there is no guarantee return of investment.

- Investment can be made via iPhone or Android Smartphones, just transfer funds to the account online.

- Allows you to invest in overseas stock market such as Dow Jones, S&P500, Tokyo Stock Exchange, in Europe and many more.

- You can customize your portfolio and diversified investment accordingly, whereas a conventional fund by Public Bank, CIMB, Maybank, Hong Leong and etc does not allow this option.

Below is the complete list of Robo Advisor or also known as Digital Investment Management approved by Malaysia Securities Commission. With it, they can advise and manage funds for both retail and accredited investors. As part of this, they comply with technology risk management guidelines, which are the same guidelines with which Malaysia banks comply.

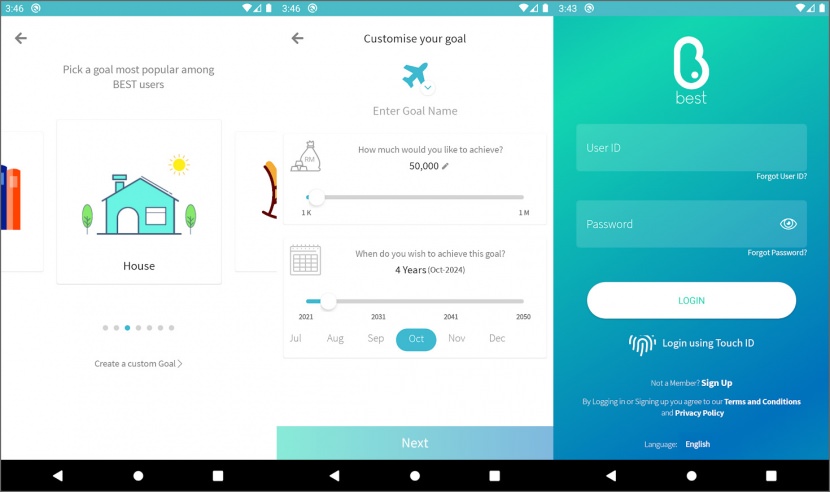

1. BEST Invest

Min investment RM10 | 0.5% – 1.2% Fees Per Year | Shariah Focused

BEST Invest is a robo-intelligence investment platform that is a non-automated discretionary portfolio management service for those who want to start saving from as little as RM10. It is a robo intelligence investment platform by BIMB Investment, a licensed Islamic fund management company regulated by the Securities Commission Malaysia.

Let them assist you to build your investment portfolio from selecting the suitable unit trust funds and how much to invest so you can achieve your investment goal. BEST app provides opportunities to invest in Shariah-ESG compliant funds developed by BIMB Investment Management Berhad (BIMB Investment), a bank-backed and wholly-owned subsidiary of Bank Islam Malaysia Berhad.

- No-Lock In Period – You can invest and withdraw anytime based on your preferences.

- Shariah Compliant – All funds listed in BEST Invest.

- No Forms To Fill – Open your account for free in a few simple steps.

- Zero Sales Charges – Your investments made through BEST Invest will be exempted from Sales Charge.

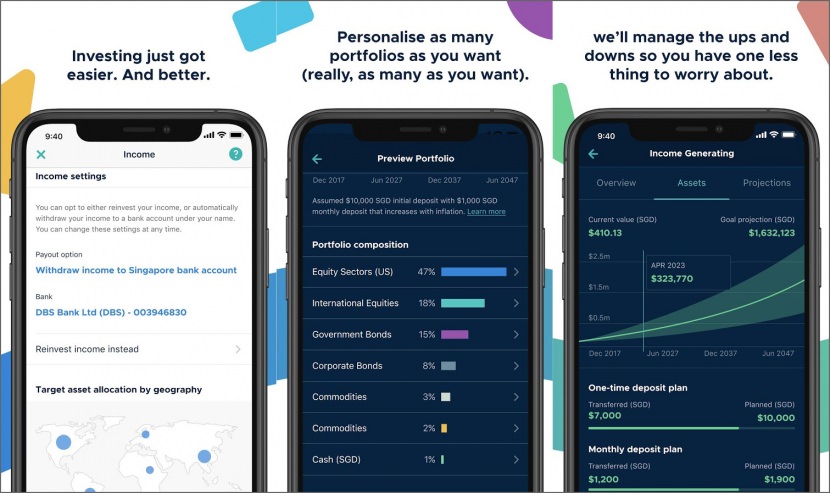

2. StashAway

Min investment RM0 | 0.2% – 0.8% Fees Per Year | USA Focused

StashAway is the intelligent wealth management platform that’s designed to build and protect your wealth, whether that’s RM5,000 or RM50 million. Whether you want to retire in 30 years with RM10 million, save for your children’s education, or simply build your wealth, we’ll build you a personalized financial plan and investment portfolios that reflect your preferences and that perform best in the current economic conditions.

Their management fee includes all transaction costs, rebalancing, automatic adjustments to optimise returns, and automatic portfolio protection. You’ll never be charged for opening an account, changing your plan, or changing your mind.

- Invest when you want – Transfer any investment amount into your portfolios whenever you’d like. You can also set up standing instructions. Or, do both!

- Withdraw when you want – You can withdraw some or all of your investments at anytime free of charge.

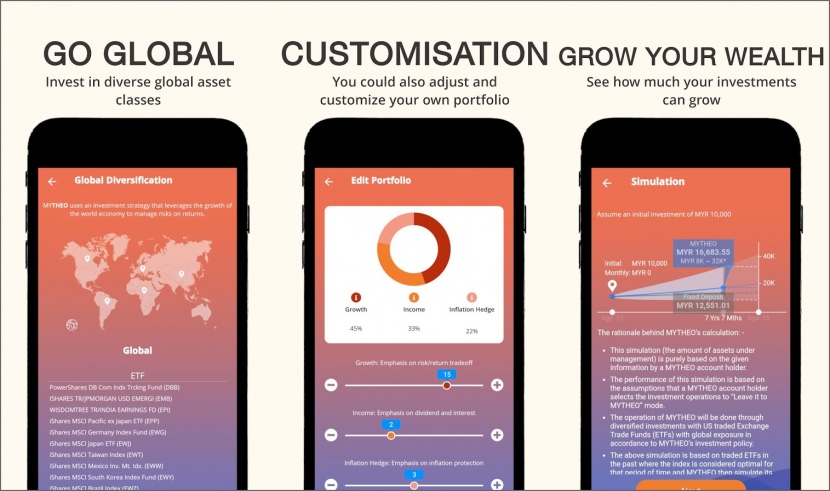

3. MyTheo

Min investment RM100 | 0.5% – 1.0% Fees Per Year | Globally Focused

MYTHEO is a digital investment management service that handles the A to Z’s of investing for you, so sit back and relax! This award-winning platform automatically creates, maintains and optimises your investment portfolio based on your profile and risk appetite.

They have a proven track record of managing over USD450mil from more than 75,000 Japanese investors with Japan’s THEO to date. Led by a team of experts with fund management experience from companies like BlackRock Inc and Nomura Holdings with the support of an innovative technology team.

Invest in over 25 ETFs globally listed in the US Market to reduce the overall risks of the portfolio and making it less susceptible to any market whims. Only 0.5% to 1% p.a. of management fees is charged. There are no hidden fees/charges – no deposit, withdrawal, trading, custodian and exchange fees!

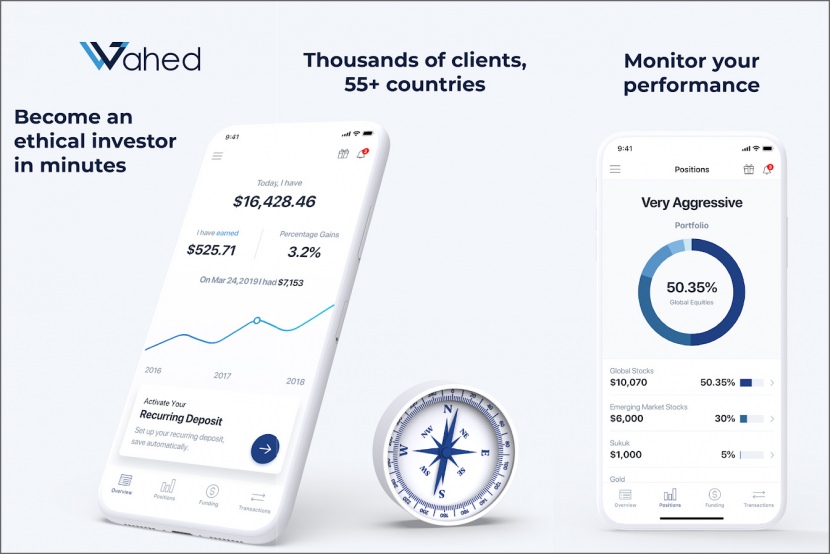

4. Wahed Invest

Min investment RM100 | 0.39% – 0.79% Fees Per Year | Shariah Focused

Wahed is the easiest way to invest your money in an Ethical manner wherever you are. You can start with just $100 with no long-term commitments whatsoever. You can place a deposit or withdrawal request at any time. Start saving for your future with this award winning and revolutionary digital Ethical investment platform – your phone becomes an investment portfolio management tool.

Wahed’s robo-advisor custom tailors recommendations based on a simple risk assessment questionnaire with one main purpose: finding the right investment strategy for you! Your money will be invested in different funds such as global stocks, emerging market stocks, Sukuk, and gold.

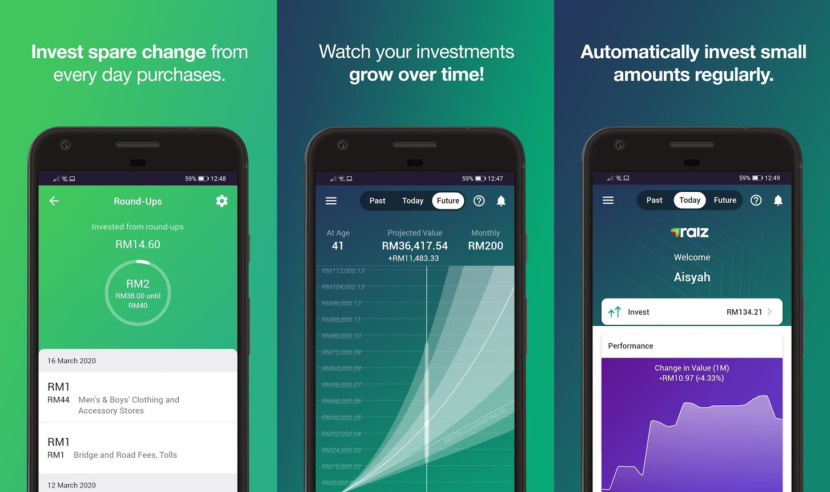

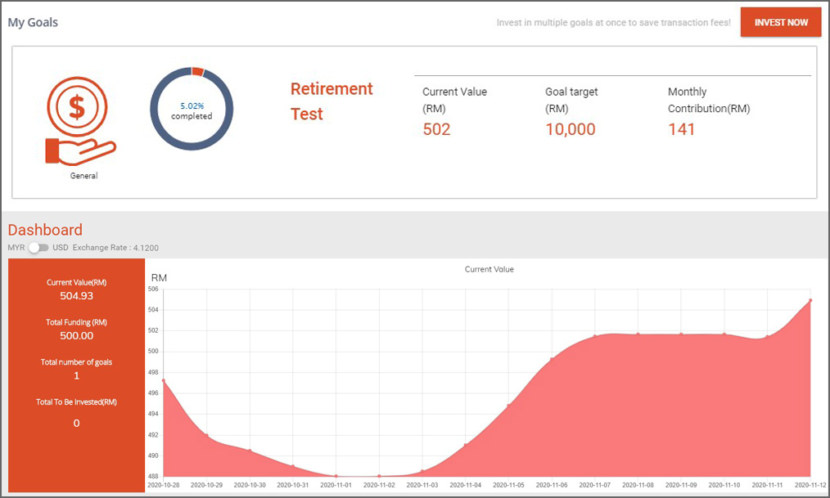

5. Raiz

Only RM1.50/month for accounts under RM6,000 and just 0.3% per year for accounts RM6,000 or more

Raiz is a financial service App, helping you to save and invest your money. They enable Malaysians to start early, invest often, and reach their financial goals. Raiz is backed by Permodalan Nasional Berhad (PNB) and Raiz Invest Australia Limited. In Australia, Raiz is listed on the stock exchange and has over 200,000 customers. It has been operating for 5 years.

- Diversification – Instead of trying to pick individual assets, Raiz diversifies your investment across several unit trust funds which consist of both international and domestic companies, corporate bonds, government bonds, money market instruments and other capital market instruments inclusive of liquid assets.

- Automatic Rebalancing – Raiz automatically rebalancing your portfolio to mitigate risk and optimize returns.

6. AkruNow

No sales charges | 0.2% – 0.7% Based on Amount Invested

Traditional solutions charge a bomb. It’s why Akru keeps things simple. They charge up to 0.7% annually of your investment. They take care of all trading fees and give you a solution that’s much cheaper and better than conventional platforms. It’s free to sign up, and to withdraw your money, any time.

You can invest any amount with Akru. Whether you have savings of RM 100, RM 1,000 or RM 50,000 they make it easy to set up an account and to start planning for your future, today. Once you’re set up, their software will manage your portfolio with automated, time-tested investment strategies to put your money to work.

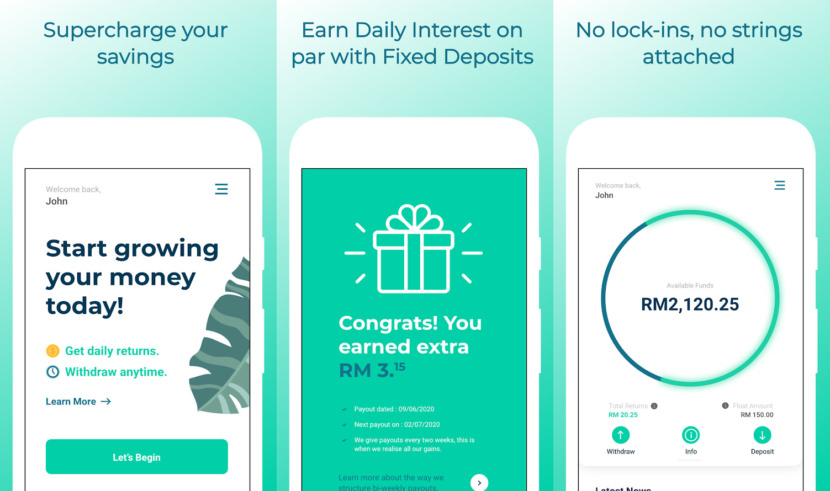

7. Versa

No sales charges | 0.30%/year management fees & 0.05%/year trustee fee

Meet Versa, a digital cash management platform that earns you interest that is on-par with Fixed Deposit (FD) and gives you the power to withdraw your funds anytime you wish, without penalties. No complications. No lock-in period. No hidden fees.

- Start saving with just RM100

- Earn FD like returns

- No lock-in periods, withdraw anytime

- No sales charges, no deposit/withdrawal or other hidden fees

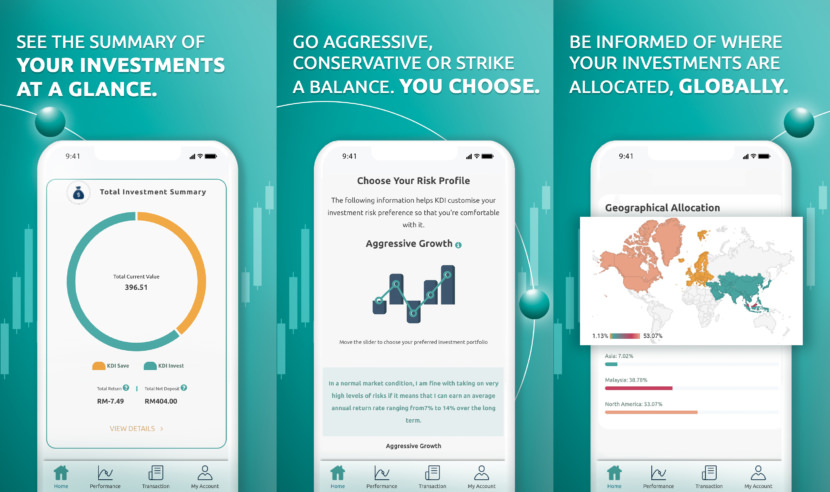

8. KDI by Kenanga

No sales charges | 0.70%/year management fees

Kenanga Digital Investing is an A.I. Driven Investing Platform. They believe that growing your wealth should be simple, affordable and intuitive. With the introduction of Kenanga Digital Investing and its A.I. driven features, you can save easily and invest confidently. Don’t wait to pursue your dreams and goals. They’ve made investing so much easier, faster and more efficient with a simple-to-understand, round-the-clock platform that you’ll start earning in no time.

Which Robo-Advisor Is The Best In Malaysia?

There is no conclusive answer. All 3 have different investment strategies, you have to do your own research. If you are unsure and have RM30,000, why not give all 3 a go. Invest RM10,000 each and benchmark the performance in 2 years time. Whichever performs the best, reallocate all funds towards that company.

My interest is in Syariah compliant robo-advisors:

I read Stashaway Simple is Syariah compliant but does this mean other Stashaway portfolio are not Syariah complaint?

Raiz funds are openly considered not Shariah-compliant by the SCM but surprisingly harus by Malaysian Islamic councils of which I prefer the former opinion.

Is Wahed Invest the only truly Syariah compliant robo-advisor in Malaysia?

As a non-muslim, I dont think I am qualify to answer your question. Sorry.

Yes Wahed is Shariah-compliant Robo-Advisor so far from what I ask from Islamic financial schooler

Hello, may I ask your source for the list of robo-advisor that has been approved by SEC