Payroll software is a computer program used to automate the payroll process for an organization. Payroll software can streamline the payroll process, reduce the risk of errors, and make it easier for an organization to stay compliant with payroll tax laws and regulations. Some payroll software solutions are cloud-based, allowing for easy access from anywhere with an internet connection.

Continue ➤ 7 Free Salesforce Alternatives – Self Hosted CRM For Small Businesses

Please note that while these systems offer free versions, they may have limitations and/or charge for additional features. It’s important to review and compare the features and costs of each option to determine which one is best for your business needs.

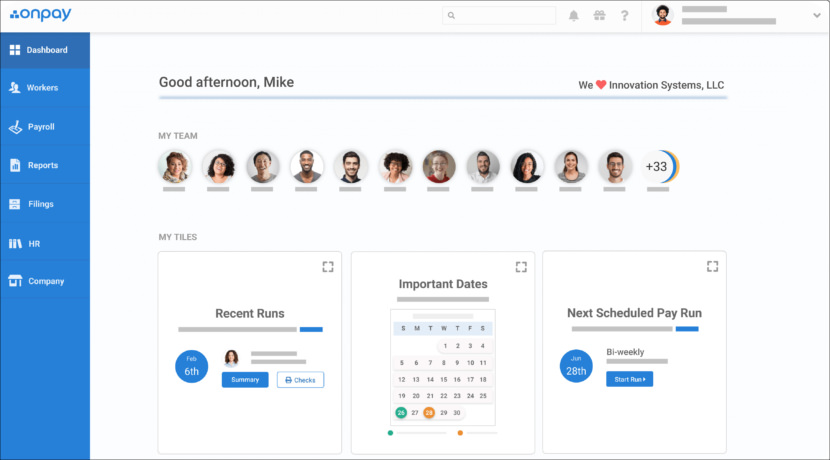

1. OnPay

OnPay is a cloud-based payroll software for small businesses. OnPay also offers a mobile app for iOS and Android devices, which allows employees to view pay stubs and request time off.

OnPay’s pricing model is based on the number of employees and the services required, with options for monthly, semi-monthly, or weekly payroll processing. A free trial is available, allowing you to test the platform before committing to a paid plan. It offers a range of features, including:

- Payroll processing: Automates payroll calculations, tax forms, and direct deposit payments.

- HR management: Offers tools for managing employee information, onboarding, and benefits.

- Compliance support: Stays up-to-date with tax laws and regulations to ensure compliance with federal and state payroll taxes.

- Time tracking: Allows employees to track time worked and approve time off requests.

- Reporting: Generates payroll reports, including W-2s and 1099s.

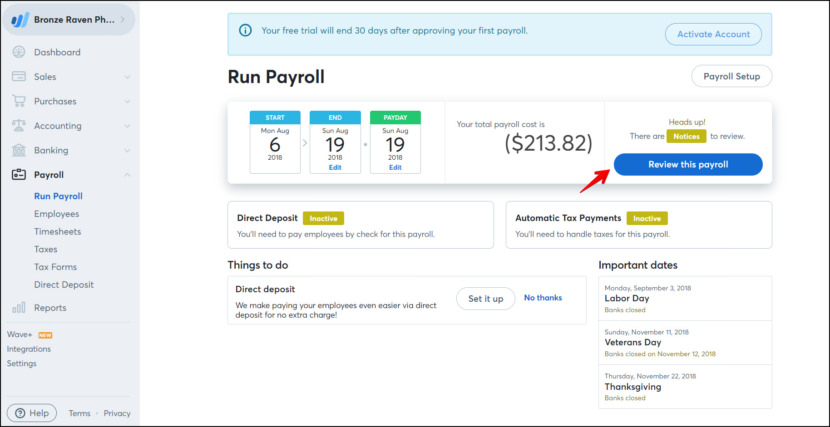

2. Wave

Wave is a cloud-based accounting and payroll software designed specifically for small businesses. In addition to payroll, Wave offers a range of accounting features, including invoicing, receipt scanning, and financial reporting. The platform is free to use, with the option to upgrade to a paid plan for additional features and support.

Wave’s interface is user-friendly and designed to be accessible for small business owners with little to no accounting experience. The platform is also highly secure, with multiple layers of protection to keep your data safe.

- Pay independent contractors and employees, and generate W2 and 1099 forms for tax season.

- Wave’s complete payroll tax service can automatically pay and file your state and federal payroll taxes for businesses in AZ, CA, FL, GA, IL, IN, MN, NY, NC, TN, TX, VA, WA, and WI.

- Employees can securely log in to access their pay stubs and W2s, and manage their contact and banking information.

- Save time with automatic tax filings and payments available in Tax Service States.

- Track leave time and accruals required to process payroll.

- Payroll automatically integrates with Wave Accounting, Invoicing, and Payments to keep your records up to date.

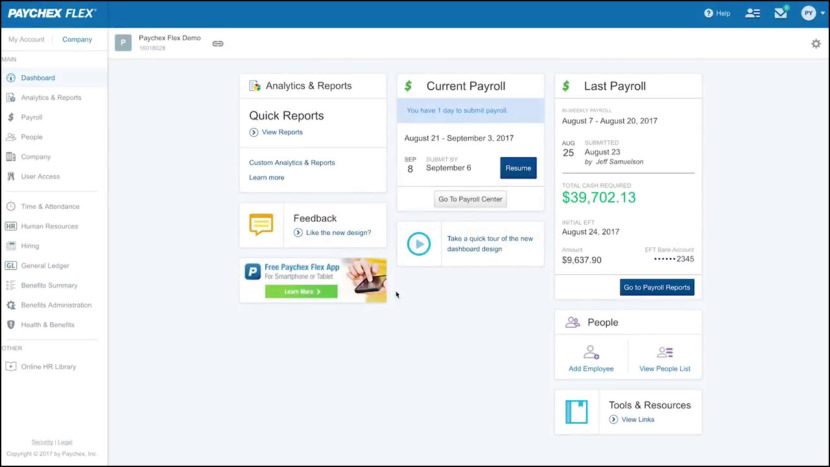

3. Paychex

Paychex is a payroll and HR solutions provider for small to medium-sized businesses. The company offers a range of services. Paychex’s services are customizable, allowing you to select the features that best fit your business needs.

The company offers online and mobile access to its platform, allowing you to manage payroll and HR from anywhere. Paychex’s pricing is based on the number of employees and the services required, with options for monthly, semi-monthly, or weekly payroll processing.

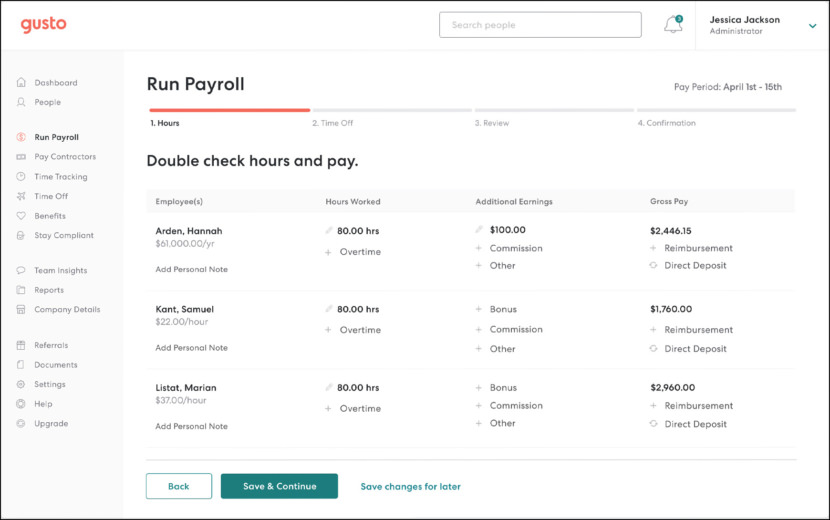

4. Gusto

Get award-winning payroll, HR, and more for one clear price. Whether your team is big, small, in-person, or remote, Gusto has the payroll, benefits, and hiring tools you need, all in one place. With Gusto, payroll takes just a few clicks. They automatically file your taxes, help with compliance, and can identify hidden tax credits to save you money. In many cases they can even transfer your payroll and benefits data for you.

- Unlimited payroll runs

- State tax registration

- International contractor payments

- Automatic W-2s and 1099s

All their features work together seamlessly on one platform — health insurance, 401(k), workers’ comp, time tracking, PTO, and more. Gusto is compatible with others too, such as Xero, TSheets, Clover, QuickBooks, Trainual, and more. Employee I-9s and W-2s, and contractor 1099s are stored and organized online.

5. Paycor

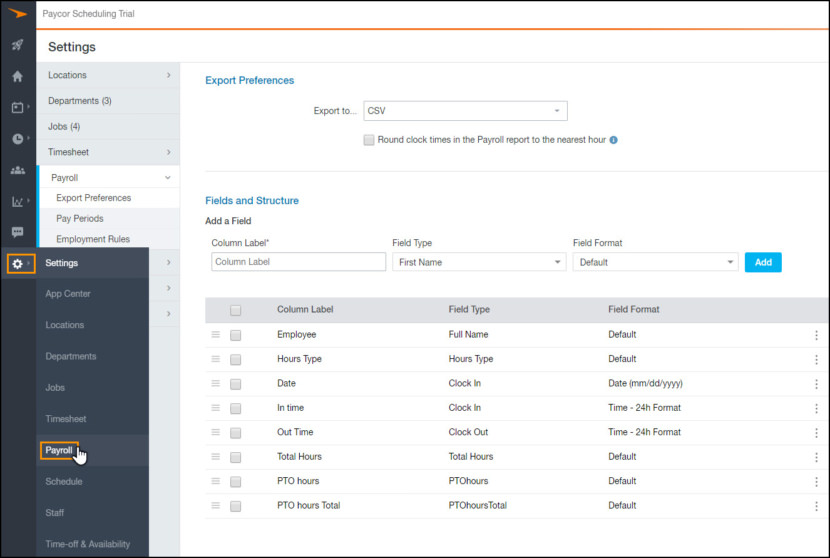

Paycor’s payroll system can transform the way you process payroll with general ledger integration, OnDemand Pay, AutoRun functionality, employee self-service and powerful reporting tools like templates, law alerts and how-to guides. Best of all? You don’t have to be the payroll expert.

Their system guides you through the process, you can make real-time calculations, so you know exactly what’s being debited before you run payroll. Their system is also flexible. With AutoRun, administrators can automatically process payroll on a specific day and time without having to be at a computer. And, behind the scenes, your payroll product is constantly updated, so you’re always in step with local, state and federal laws.

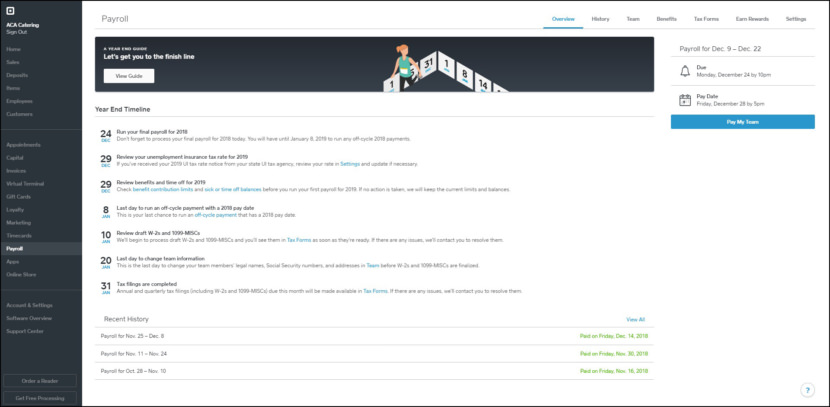

6. Square Payroll

Square Payroll is a payroll solution for small businesses integrated with Square’s point-of-sale system. Everything you need to run payroll at a low monthly cost with no hidden fees. Pay employees and contractors: $35 monthly subscription fee + $5 monthly fee per person.

Getting the right payroll software for your small business will free up a lot of your valuable time. Payroll services for small businesses work for employers, employees, and contractors. Just enter the appropriate details, and Square Payroll helps you pay your staff and contractors with the right deductions and documents.

Their payroll software takes care of your federal and state tax filings and payments at no additional charge. Square Payroll handles sending and filing 1099-NEC forms and also deals with 940, 941, 944 forms, and W-2 and W-3 Social Security forms across all states — no matter what benefits you offer.

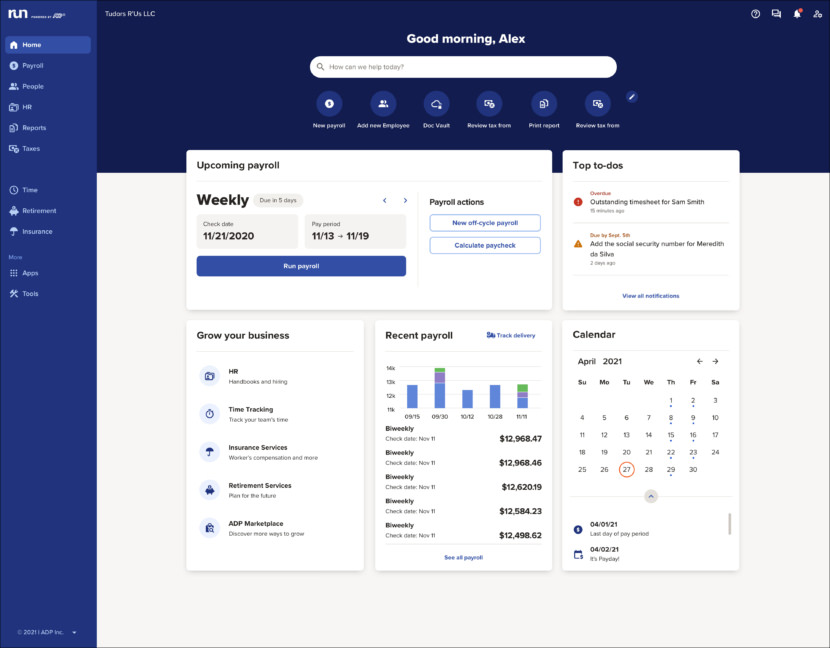

7. ADP

Payroll services designed for your business. Join the 1,000,000+ companies who trust ADP for payroll services and tax support backed by unmatched expertise. Perfect for startups and established companies that simply need payroll, taxes, and compliance they can trust. Get payroll done in just a few clicks (or set it to run automatically), plus taxes filed for you.

In addition to taking work off your plate and freeing up time for you and your staff, ADP stays on top of changing rules and regulations — to help keep you compliant and protect you from potential fines and penalties. ADP provides customized payroll services, solutions and software for businesses of all sizes.

8. BambooHR Payroll

Trying to predict labor costs and make strategic payroll decisions without the right data is as risky as crossing the street blindfolded. But tracking down and reporting on all that information by hand is just as crazy. That’s why BambooHR gives you instant access to over 100 standard, exportable payroll reports—because whether you’re looking to evaluate cash requirements, assess total deductions, or analyze a complete payroll summary per employee, you can trust their payroll software to keep everyone on the same page.

A single trusted source of data—With BambooHR managing the data you need to run payroll, you can feel confident that when you make an update, the right data automatically flows into payroll.

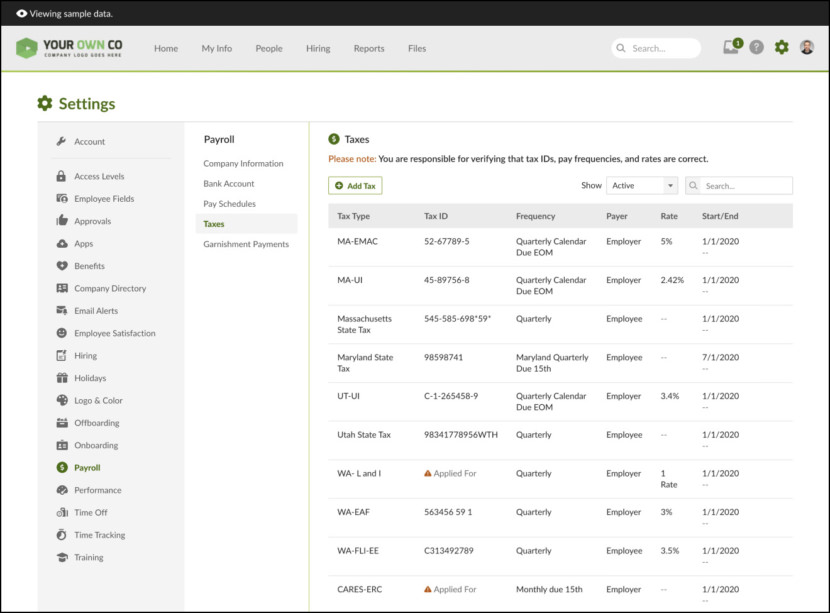

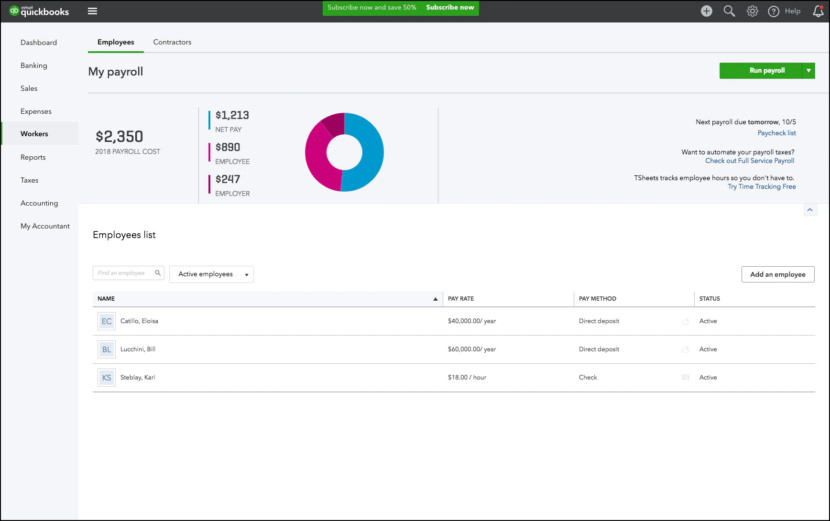

9. QuickBooks Payroll

QuickBooks Online Payroll works for small to midsize businesses—from accountants and financial experts to nonprofits, construction companies, and restaurants. You can customize, run, print, or export a payroll report and share valuable insights with your accountant. Payroll reports cover the following: multiple worksites, payroll deductions and contributions, payroll tax liability, payroll tax and wage summary, time activities, vacation and sick leave, and workers’ comp.

Get payroll that’s accurate, automatic and easy to use. Approve payroll when you’re ready, access integrated employee services, and manage everything in one place. Compatible with taxes in most states such as California, Texas, Florida, New York, Pennsylvania, Illinois, Ohio, Georgia, North Carolina, Michigan, New Jersey, Virginia, Washington, Arizona, Massachusetts, Tennessee, Indiana, Maryland, Missouri, and etc